Understanding the economy can be challenging, but the Circular Flow Model simplifies it by showing how money moves through different sectors. If you’ve ever wondered how your spending impacts the broader economy, this model has the answer.

The article will break down this concept, impart why it’s essential for you to grasp how economic activity flows between households, businesses, and governments.

In a world where financial decisions feel more critical than ever, understanding the Circular Flow Model could be your key to making informed choices. Keep reading to discover how this model relates to real-world economics and your everyday life.

What Is the Circular Flow Model?

The circular flow model explains how money moves around in an economy. It shows that money goes from businesses to workers as wages, and then workers spend that money on goods and services, sending it back to businesses. Essentially, money is always moving in a circle within the economy.

This is the basic idea, but in reality, the flow of money is more complex. Economists have added extra details to make the model more accurate for today’s economies. These extra details represent the different parts of a country’s total economic activity, also known as the gross domestic product (GDP) or national income. Because of this, the model is sometimes called the circular flow of income model.

Knowing the Circular Flow Model

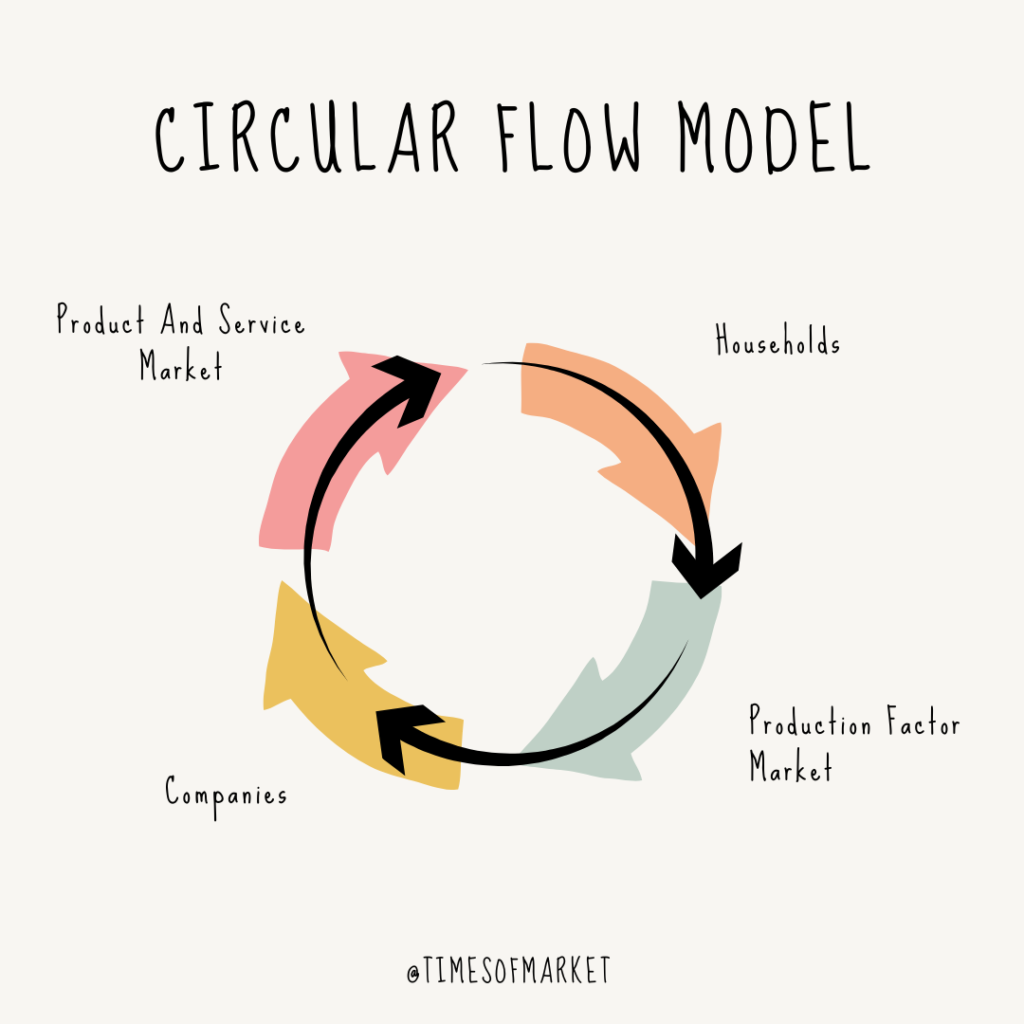

The main idea behind the circular flow model is to show how money moves around in an economy. It focuses on two key groups: households (people like you and me) and businesses (companies). It also divides the economy into two main areas: the markets where goods and services are bought and sold, and the markets where resources like labor, land, and capital are traded.

This model helps us understand how a country’s income is generated by showing the flow of money in and out of the economy. It also illustrates how different parts of the economy are connected. For example, when the government changes tax rules, it affects how much people can spend, which then impacts how well businesses can sell their products.

The model is called “circular” because money is always moving from one part of the economy to another, benefiting each sector along the way. The idea is that no single part of the economy should hold onto all the money; instead, the money should keep flowing so that every part can keep functioning properly. The diagram below shows one version of this model, but it’s important to note that there are other variations as well.

Example of Circular Flow Models with Different Sectors

There are various versions of circular flow models, each showing a different number of parts it tracks. Below is a list of possible parts that might be included in a circular flow model. In these models, each part is often represented by a capital letter, which is typically used when figuring out a country’s total economic output, known as GDP.

Foreign Sector

In a more complex economy, money enters the system through exports, which means selling goods or services to buyers in other countries. This suggests that simpler models of the economy, like those with two or three sectors, only focus on what’s happening within a country. The foreign sector is different from the domestic one because dealing with other countries can involve extra costs, like import taxes and fees, which can cause money to be lost along the way.

Government Sector

In a model where we look at three parts of the economy, the government plays a role in how money moves around. The government adds money into the system by spending on things like Social Security or the National Parks. On the other hand, it takes money out of the economy by collecting taxes from people and businesses.

Business Sector

In a simple model of the economy, there’s a flow of money between two main parts: households and businesses. Businesses make the goods and services that people use. To do this, they have to pay for different things like workers, materials, and other expenses. By covering these costs, businesses can create products that help others, whether it’s through providing jobs or offering things people need.

Household Sector

In a basic model of the economy, everything starts with households, or regular people, who spend money on things they need and want. People help the economy by working, which means they give their time and effort, and by spending money on products and services. In exchange, they get to enjoy those products and also benefit from government services and programs.

Financial Sector

In a model with five parts, the financial sector is included to show how money moves around. This part includes banks and other places that offer loans and financial help. Some versions of this model also highlight what investors do, showing how money from business owners and investors can flow into companies, while the money companies make as profits flows out.

Circular Flow Model: Implications and and Outflows

Just like money can flow into an economy, it can also flow out in different ways. For example, when the government collects taxes, it takes money out of the economy. Money spent on buying goods from other countries also leaves the economy. And when businesses save money instead of spending it, that’s another way money is taken out of the system.

To understand how well the economy is doing, the government keeps track of both the money coming in and the money going out. The economy is considered balanced when the amount of money flowing out is equal to the amount flowing in.

The level of injections is the total of government spending (G), exports (X), and investments (I).

The level of leakages or withdrawals is the total of taxation (T), imports (M), and savings (S).

When the total amount of money coming into an economy (like investments, government spending, and exports) is higher than the total money leaving the economy (like savings, taxes, and imports), the country’s economy will grow.

On the other hand, if more money is leaking out than coming in, the economy will shrink. As long as the money flowing into the economy is more than the money leaking out, the economy can keep going strong. But if there’s not enough cash coming in, the country needs to find extra money to cover the gap.

The calculation of Gross Domestic Product(GDP)

Gross Domestic Product (GDP) is a way to measure how much a country is producing and spending. It’s calculated by adding up what people spend, what the government spends, what businesses invest, and the difference between what a country sells to other countries and what it buys from them. The formula is GDP = C + G + I + (X – M).

If businesses start producing less, people might spend less because there are fewer goods and services available. This drop in spending can cause GDP to go down. On the other hand, if people decide to spend less, businesses might produce less because there’s less demand, which also lowers GDP.

GDP helps us understand how well an economy is doing. When GDP falls for two straight quarters (or six months), it often means the country is in a recession, which is a period of economic trouble.

To help improve the economy during a downturn, governments and central banks can change their financial strategies. For instance, Keynesian economics suggests that spending drives economic growth. So, a central bank might lower interest rates to make borrowing cheaper.

This encourages people to buy more things like homes and cars, which boosts overall spending. As spending goes up, businesses produce more and hire more workers. More jobs mean more wages, leading to even more spending and a cycle that helps the economy recover.

What defends the Name “Circular Flow Model”?

The economy works like a loop where money keeps moving between different parts. People spend money on goods and services, and businesses use that money to make new and better products. These businesses then pay people for their work.

When you include the roles of governments, investors, and international trade, this loop shows how money flows from one part of the economy to another in a clear, organized way.

What Results Can Be Expected from a Circular Flow Model?

A circular flow model shows how money moves around in an economy without necessarily leading to a specific end. It highlights the current state of how money is coming in and going out. This helps people make decisions to improve the economy. For example, if a country finds out it’s not earning enough, it might decide to cut down on imports or reduce some government programs.

Constraints of the Circular Flow Model

A circular flow model shows how money moves around an economy at a certain point in time. But it doesn’t really explain how changes in one part of the economy affect everything else. For example, if unemployment goes up by 5%, it can be hard to see exactly how this will change other parts of the model.

We know that higher unemployment means people have less money to spend and the government gets less in taxes, but the model doesn’t show exactly how these changes affect each other.

Example of Circular Flow Model

The Circular Flow Model is an economic model that depicts the movement of goods and services, resources, and money in an economy. Here’s a simple illustration of how the Circular Flow Model works:

Households:

Households provide labour to enterprises in exchange for wages. Consume Goods and Services: Households spend their income on goods and services from businesses.

Businesses: produce items and services for sale to homes.

Pay Wages: Businesses compensate households for their labour.

Government:

Collects Taxes:The government collects taxes from individuals and corporations.

Public Goods and Services: Tax revenue is used by the government to fund public infrastructure, education, and healthcare programs.

Financial Markets

Savings and Investments: Households save money in financial institutions, which firms utilise to invest.

Loans and Borrowing: Businesses and individuals can borrow money from financial markets to fuel their operations.